5 Best investment apps in 2023

Best investment apps are a great way to make money and grow your portfolio without the hassle of traditional investing. These apps provide a convenient and easy way to access the stock market, manage your portfolio, and track your investments. Many of them offer educational content and tools, making them ideal for beginner investors. Stash is one of the best–known investment apps, offering a suite of features designed to make investing easy. The app allows you to choose from a range of investments, including stocks, ETFs, and bonds. You can also set up automatic investments and track the performance of your portfolio. Wealthfront is another great investment app for beginners. It offers an automated portfolio management service that takes the guesswork out of investing. The app also provides personalized recommendations based on your goals and risk tolerance.

Contents

1. Choose an Investment App:

Before you start investing, it’s important to choose an app that meets your needs. Consider factors such as the app’s fees and commissions, investment options, user experience, customer service, and security measures.

Features

- Goal Tracking: Set savings goals and track your progress towards them.

- Automated Savings: Automatically transfer funds from your bank account to your investment account on a recurring basis.

- Portfolio Management: Analyze and optimize your portfolio to maximize your returns.

- Tax Management: Monitor and manage your tax liabilities when investing.

- . Investment Education: Access tutorials and educational resources to learn more about investing.

Real-Time Market Information: Get real-time information on the markets to make informed decisions. - Risk Management: Manage risks associated with specific investments.

- Security: Protect your data with multi-level authentication and secure encryption.

2. Set Your Investment Goals:

Before you start investing, it’s important to set your financial goals. Think about what you’re hoping to achieve with your investments and how much risk you’re willing to take.

Features

- Ability to set individual goals and timelines

- Investment tracking to help monitor progress

- Visualizations to help the user visualize the progress of their investments

- Alerts to notify the user when goals have been met or when performance has dropped

- Tools and advice to help the user make informed decisions

- Access to expert opinion and portfolio advice

- Tax planning and portfolio optimization guidance

- Automatic portfolio rebalancing

- Financial education and resources to help the user enhance their understanding of investing

- An easy-to-use mobile app for access on the go

- Secure online access and storage

3. Research Your Investments:

Once you’ve chosen an app and set your goals, take the time to research your investments. Read up on the companies, funds, and securities that you’re interested in and decide which ones are most suitable for your investment goals.

Features

- When researching investments, it is important to consider a variety of factors.

- These factors include the type of investment, its performance history, the amount of risk associated with the investment, its fees and costs, and the level of diversification it offers.

- Additionally, it is important to consider the features of the investment, such as the availability of tax benefits, the ability to access funds quickly, and the ability to customize the investment.

- Finally, investors should research the reputation and track record of the company offering the investment, the quality of customer service, and the security of the investment.

4. Monitor Your Portfolio:

Once you’ve invested, monitor your portfolio regularly. This will help you stay on top of any changes in the market and make sure that your investments are on track to meet your goals.

Features

- Real-time portfolio tracking: Monitor your portfolio in real-time and stay up-to-date with the latest market news and trends.

- Detailed analytics: Generate insights on your investments with detailed analytics and performance metrics.

- Custom portfolio monitoring: Track and manage your portfolio with custom criteria, including asset class, sector, and industry.

- Automatic portfolio rebalancing: Automatically rebalance your portfolio to maintain your desired asset allocation.

- Risk management: Monitor and manage your exposure to risk with customizable risk management tools.

- Tax optimization: Optimize your portfolio for tax purposes with tax-efficient strategies.

- Portfolio diversification: Diversify your portfolio to maximize returns and minimize risk.

- Alerts and notifications: Receive alerts and notifications when your portfolio needs to be rebalanced or market conditions change.

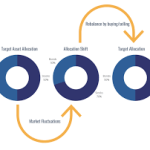

5. Rebalance Your Portfolio Regularly:

Over time, your investments may become unbalanced. This can happen as a result of market fluctuations or other factors. To ensure that your investments remain aligned with your goals, rebalance your portfolio regularly.

Features

- Rebalance at predetermined intervals: Set a timeline for when you will rebalance your portfolio, such as once a year or quarterly, to ensure that your investments are in line with your risk tolerance.

- Monitor portfolio performance: Monitor your portfolio performance and make adjustments as needed to ensure that your investments are diversified and in-line with your goals.

- Reallocate assets: Reallocate assets within your portfolio to ensure that your investments are diversified and in-line with your risk tolerance and goals.

- Rebalance your portfolio: Rebalance your portfolio on a regular basis to ensure that it is properly diversified and in-line with your risk tolerance and goals.

- Consider taxes: Consider taxes when making portfolio changes, as they can significantly impact the performance of your investments.

- Automate the process: Automate your portfolio rebalancing process to ensure that it is done on a regular basis and in-line with your risk tolerance and goals.